What is Pix?

Within the Brazilian instant payment (IP) ecosystem, Banco Central do Brasil (BCB) created Pix, the Brazilian IP scheme that enables its users — people, companies and governmental entities — to send or receive payment transfers in few seconds at any time, including non-business days.

By transferring funds between transactional accounts — demand, savings and prepaid payment accounts — Pix is a payment method that tends to have a lower acceptance cost because its framework works with few intermediaries.

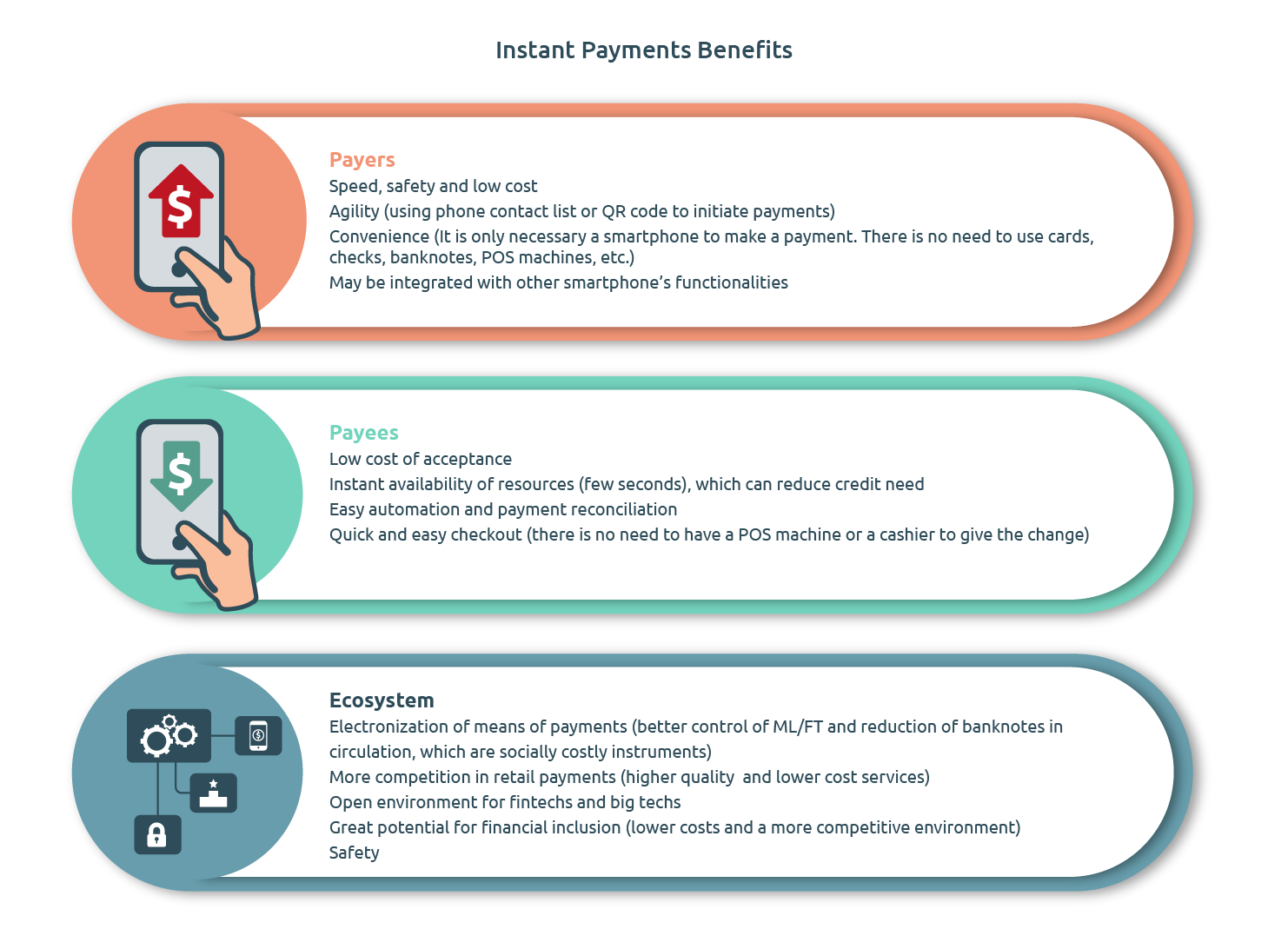

In addition to increasing convenience for the users making payments, Pix promotes:

- Lower financial costs, increased security and improved customer experience

- Digitization of the retail payments market

- Higher market competition and efficiency

- Financial inclusion

- Gap-filling of retail payment instruments available to the population.

Pix belongs to the Brazilian citizen life and business environment

Since November 16th, 2020, Pix performs your instant funds transfer, which can be further facilitated if the beneficiary has registered a Pix alias associated to her/his/its transactional account.

Pix aliases are portable and the users’ information stored in the database are encrypted and protected by law.

Pix - Wherever and Whenever

Pix is an easy, fast and affordable experience for end users and businesses, delivering a safe and versatile solution for payments and transfers.

Available around the clock, every day of the year, Pix can promote financial inclusion, as well as competition, owing to its fair and open access requirements, which allow for the participation of several kinds of payment service providers.

Pix features

Instant solution

An instant payment solution that settles funds transfers in a few seconds, assuring the immediate availability of funds to the final beneficiary.

Full-time availability

24 hours every day, including no-business days.

Convenience

Simple experience for end users. Convenient for businesses.

Low-cost functionality

No fees for people.

Low cost for businesses, considering a very competitive market

Versatility

Multi-solution framework for payments and transfers, regardless of type or amount of the transaction, throughout a broad range of customer segments: people, businesses and governmental entities.

Integrated processing

Funds and information go hand in hand, facilitating the process automation and conciliation of payments.

Open environment

As an open payment scheme, Pix transactions can be performed between any payment institutions or financial institutions that comply with the Scheme’s access rules, which are objective, risk-based, and publicly disclosed.

Safety

Robust mechanisms and measures to ensure the security of the transactions and information used.

How Pix works

One of the greatest advantages of Pix is its transactions’ speediness. And it is fast even before the transaction is initiated. Instead of asking for information regarding the beneficiary’s account and/or personal data, the payer just asks for the Pix alias or scans a QR code (static or dynamic) in order to start a Pix funds transfer at any day and time.

Additionally, Pix tends to have a lower acceptance cost for merchants and businesses in general, because its transactional framework has fewer intermediaries than traditional methods of payment.

Once started, Pix transactions are irrevocable and processed individually in a few seconds. Pix will promptly notify the end users (both payer and payee) of the transaction’s conclusion. With the payment confirmation, the payer has certainty that the payment was received and funds are available for the beneficiary. It must be emphasized that the Pix alias is only used to facilitate initiating a Pix transaction and, therefore, to pay with Pix it is not necessary to register a Pix alias.

Traditional payment methods

Pix will be another element in the set of payment instruments available at the Brazilian retail payments system. As such, traditional payment instruments, such as TED, DOC and Boletos (bank slips) will continue to be offered; the same holds for credit and debit cards. Therefore, it is the end user’s discretion to choose the best payment instrument for the occasion.

More details on the characteristics of Pix vis-à-vis other payment methods are available in the Pix FAQ.

Pix transactions

Pix participants (whether a financial or payment institution) will provide Pix transactions mostly through their mobile apps and Internet banking platforms. A Pix transaction will typically be initiated through the usage of a predefined alias or a QR code associated with the beneficiary’s transactional account. From bank to fintech, from fintech to payment institution, among others, Pix can be processed between:

- Person-to-Person (P2P)

- Person-to-Business (P2B)

- Business-to-Business (B2B)

- Person-to-Government (P2G)

- Business-to-Government (B2G)

Thresholds for Pix transactions

Within the scope of Pix, there is no minimum limit for payments or transfers. Nevertheless, in order to mitigate instant fraud risk and/or prevent money laundering and terrorist financing (AML/CTF initiatives), Pix participants may establish maximum limits for Pix transactions per payer, per day and per month. Pix rules establish minimum parameters for these limits, which participants must comply with.

The account holder may reduce these limits for Pix transactions debiting his account (participants must obey such requests). On the other hand, granting requests for increasing the limits is at the discretion of the participant.

Regulation: BCB Normative Instruction No. 20/2020 (only in Portuguese).

Pix day-to-day uses

End users’ identification

Pix alias

Since October 5th, 2020, account holders in Pix participating institutions can electronically register their chosen Pix aliases to facilitate receiving instant funds transfers. Linked to the recipient’s account information, Pix alias can be a mobile phone number, an e-mail address, the Taxpayer Identification Number (CPF or CNPJ), or a randomly generated alphanumeric string (for users who do not want to link their personal data to their transactional account information).

The Pix aliases are portable, i.e., the user can link it to another account at any time. At the user's discretion, up to five aliases can be assigned to each transactional account (up to 20 aliases, for legal entities). A Pix alias must be associated with only one transactional account.

Pix alias report

Upon request and previous accreditation, every end user may access the BCB’s ”Registrato” system to obtain a real-time document that consolidates all Pix aliases associated with accounts she/he/it holds at a Pix participant (financial or payment institution). In case of inaccurate information, Pix users should contact the involved institution directly. If the problem is not solved, the client can file a complaint at www.consumidor.gov.br or contact BCB through Contact Us channel.

Safety

Pix operates through a centralized framework comprising messaging communication among the various participants and BCB (as the provider of Pix settlement system, namely the Instant Payments System - SPI). Its transactions are not performed with blockchain technology. Instead, all transactions take place through digitally signed messages exchanged, in encrypted form, through a private network apart from internet.

- Users’ information is encrypted in the ‘Transaction Accounts Identifier Directory’ (DICT) — the sole alias database operated by BCB —, where Pix aliases and associated account information are stored and protected by mechanisms that prevent information scanning.

- DICT also provides indicators that can support fraud prevention by Pix’s participants.

BR Code – standard for initiating payments with QR Code

Starting October 2020, all payment schemes operating in Brazil that uses QR Codes (a the two-dimensional barcode) for payment initiation have to adapt them to the BR Code, the standard QR code for payment initiation (which is compatible with EMV®).

Privacy

In order to protect the privacy of Pix users, regulation on the Transaction Account Identifiers Directory (DICT) establishes that institutions operating in the National Financial System (SFN) comply with the Brazilian General Data Protection Act (‘Lei Geral de Proteção de Dados’ – LGPD), which establishes rules on collecting, handling, storing and sharing of personal data managed by organizations.

Safety

Pix security framework is based on four dimensions:

- User authentication

- Transactions traceability

- Safe traffic of information

- Pix rules

- Participants of Pix ecosystem (financial and payment institutions) are accountable for frauds caused by mismanagement of risks.

- protection mechanisms — implemented by the BCB and by the institutions — prevent scanning of personal information associated to Pix keys.

- the possibility for Pix participants to set value ceilings for transactions, based on the customer’s risk profile according to the time and/or day of the transaction, account ownership, service channel, user authentication mechanism, among others;

- the possibility to Pix users themselves to adjust the value limits established by the institutions through the applications. The request for celling reductions have immediate effects, while to increase, the requests is subjected to analysis, where the institutions verifies the customer profile compatibility;

- Pix authorization timing can differ so that institutions can verify unusual transactions with high probability of fraud;

- information center - where all Pix participants institutions can share information about Pix keys, account numbers and TINs (CPF/CNPJ) involved in any fraudulent transaction;

- dynamic QR Code generation is allowed only for participants who send specific security certificates to the BCB; and

- mechanisms facilitate the blocking of funds and their possible return to the sender in case of fraud, such as the precautionary blocking and the special return mechanism.

All Pix proceedings, including those related to the management of Pix keys, can only be initiated inside a secure environment, on the user´s institution access area, using a password or other security features integrated into the mobile phone — such as biometric or facial recognition and token-based authentication;

Given its technological design, all Pix operations are fully traceable, allowing the identification of accounts receiving funds associated to fraud/coup/crime, which allows more incisive action by the police and judicial powers, in opposition to what happen with ATMs withdrawals.

The transactions information is encrypted in the National Financial System Network (RSFN) — a network completely separated from the internet — where all transactions of the Brazilian Payment System (SPB) take place. Particularly, all Pix participants have to issue security certificates to transact through the RSFN. In addition, all transaction information and personal data linked to Pix keys are stored in encrypted form at the BCB's internal systems;

Pix regulation provides measures to mitigate fraud risk, such as:

For further information on Pix security features, see Pix Q&A .